Beyond the Pension: Funding Sources for Senior Living

Are you interested in senior living, but worried your pension won’t be enough to cover it? Or, perhaps you assume that without a pension you won’t be able to afford it at all. We can help you put those concerns to rest. There are a number of funding options beyond a pension for senior living. Let’s take a look.

Take Stock

A pension is a great asset to have, but you may also have other resources at your disposal that can help offset the cost of senior living such as:

YOUR HOME

Learn its market value, then consider the possibility of selling or renting it if needed.

SAVINGS

Do you have savings available? What about stocks, bonds or annuities?

INCOME

Beyond any potential pension, what about Social Security or dividends from stocks?

Know How Much You May Need

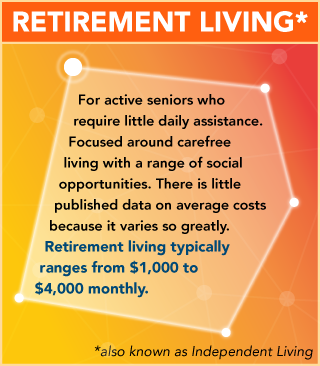

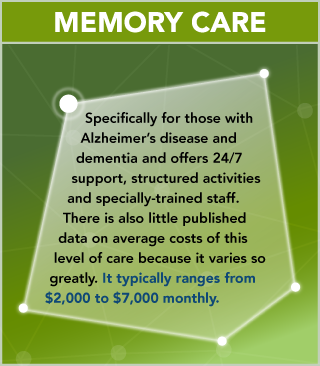

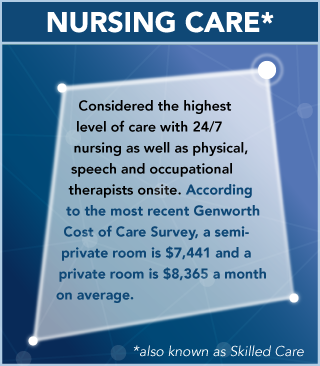

It’s impossible to predict whether or not you will need long-term care, however, according to the U.S. Department of Health and Human Services, an estimated 70 percent of people over age 65 will at some point. So it’s important to know what to expect in senior living, as cost is tied to the level of care you need.

Think of it as a constellation:

Other Ways To Offset The Cost Of Senior living

In addition to your pension and/or the other resources listed above, these funding sources can also help to offset the cost of senior living:

Wartime veterans or a surviving spouse with limited income may be eligible to receive a non-service connected pension (above the basic pension) to assist in paying for assisted living, home health care, adult day care or skilled nursing if you meet certain conditions.

LTC can help you pay for the cost of home care, adult day care, assisted living, memory care, skilled nursing and hospice by covering services typically not covered by health insurance, Medicare or Medicaid.

You may be able to convert an in-force life insurance policy into a pre-funded financial account that disburses a monthly benefit to help pay for needs such as home care, assisted living, skilled nursing and hospice.

A type of home equity loan for those 62 or older who want to access their home’s equity to supplement retirement income.

The National Council of Aging also has a free service known as BenefitsCheckUp® that provides a list of benefits in which you may qualify from more than 2,500 federal, state and private programs based on your criteria.